non filing of income tax return notice under which section

AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. Rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine where tax sought to be evaded exceeds Rs.

Understand Income Tax Notices Learn By Quickolearn By Quicko

Click on View and Submit Compliance to submit your response to the non-filing compliance notice.

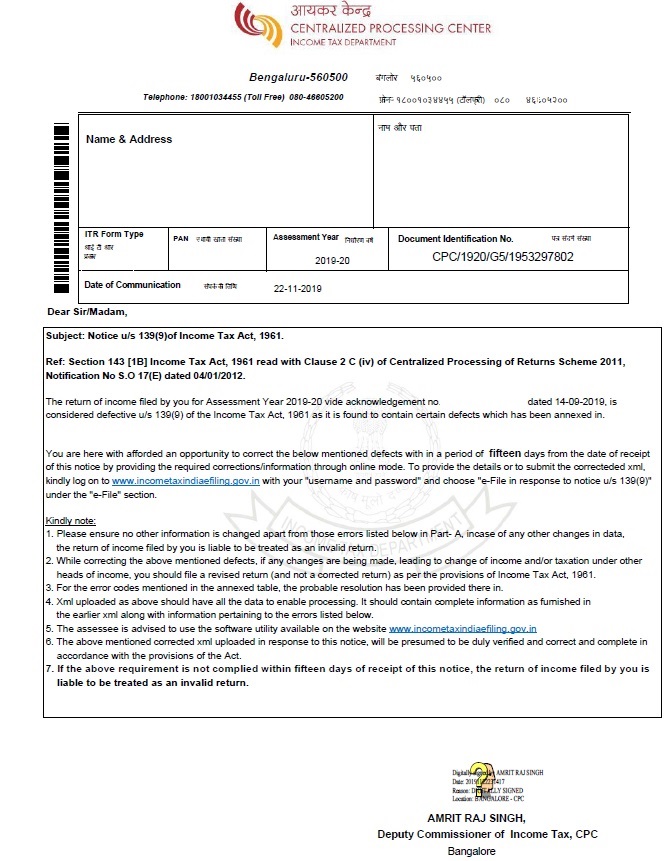

. If your return is found defective the Income Tax Department will send you a defective notice under section 139 9 of the Income Tax Act via an email on your registered email id or post and the same can be viewed by logging in on the e-filing portal. Carry forward of Losses not allowed except in few exceptional cases. You can find another option view my submission.

Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the assessee under Section 142 or Section 148 of the Act. According to Income Tax Ordinance 2001 updated up to June 30 2019 issued by the Federal Board of Revenue FBR explained the different amount of fine and penalties for non-compliance to mandatory requirement. Now it is important to understand that notice under section 1431 and 1431a are two different notices and the way of dealing them is also different.

If ITR is not filed even after these measures the concerned individual might face prosecution under Section 276CC of the Income Tax Act for tax evasion. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such form. A new section 206AB has been introduced by the Finance Act 2021 which is going to increase TDS compliance burden of corporates and businessmen in a great manner.

This section requires that the person payer who deducts TDS in case of a payee who is a non-filer of income tax. Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer. Click on Compliance Menu Tab.

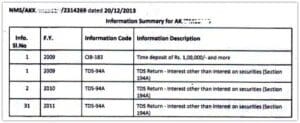

The Income Tax Dept collects information through various sources and then based on their own analysis send notices to people who have carried out specified transactions. 1 Under section 139 1 every person has to furnish a return of his income on or before the due date if his total income exceeds the basic exemption limit. Section 114 of the Ordinance is related to persons required to file annual income tax returns and Section 116 is related to filing of wealth.

You get a defective return notice under section 139 9 of the Income Tax Act. Once received you need to respond to it within 15 days from the date of receiving the notice. Many taxpayers have received notice under section 1431a after filing their Income-tax returns for AY 2017-18 or AY 2018-19.

Failure to file the return of income in response to a notice issued under section 1421i or section 148 or section 153A. On Filing or Non-Filing of Income Tax Return us. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A.

Let us know about the amendment proposed by Finance Bill 2022 by Non filer of income tax return under section 206AB and 206CCA. In order to widen and deepen the tax-base and to nudge taxpayers to furnish their return of income Finance Act 2021 inserted sections 206AB and 206CCA in the Act. The proviso to Section 276-CC gives some relief to genuine assessees.

TDS in case of non-filers of Income Tax Return- Section 206AB of Income Tax Act. 139 1C Specified class or classes of persons to be exempted from filing Return of Income Section 139 1C. May lead to Best judgment assessment by the AO us 144.

If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the assessee shall be made to pay interest under Section 2433 for late filing of Income Tax return or for not filing of Income Tax return if the income has already been determined under Section. So one should not get confused between the two. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department.

Failure to file the return of income as per section 1391. 1 lakh upto 30-6. Section 142-1 of income tax act.

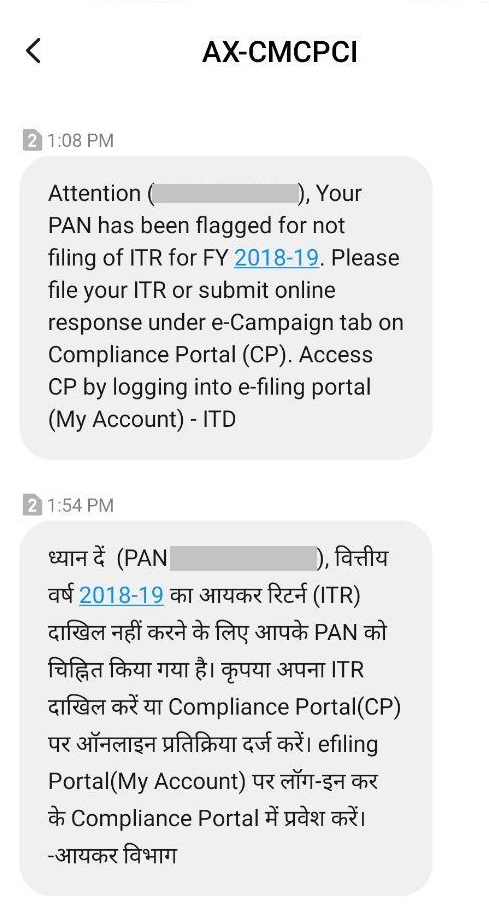

Income tax notice us 1421 is sent if you have not filed the return or if the returns are incomplete. Compliance Income Tax Return filing Notice This notice is sent to people by the Income Tax Dept if they think that the person has some taxable income but the ITR has not been filed for such income. Contact us for ease in filing returns.

This notice is about some dues which the tax payer owes to the department. If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed. 139 1 and us.

Here you can view information about your non-filing status. Consequences of non-filing of Income Tax Return.

Irs Letter 1615 Mail Overdue Tax Returns H R Block

How Should You Respond To A Defective Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Handle Income Tax It Department Notices Eztax

What Is A Cp05 Letter From The Irs And What Should I Do

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block

How To Respond To Non Filing Of Income Tax Return Notice

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

Responding To Defective Return Notice U S 139 9 Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

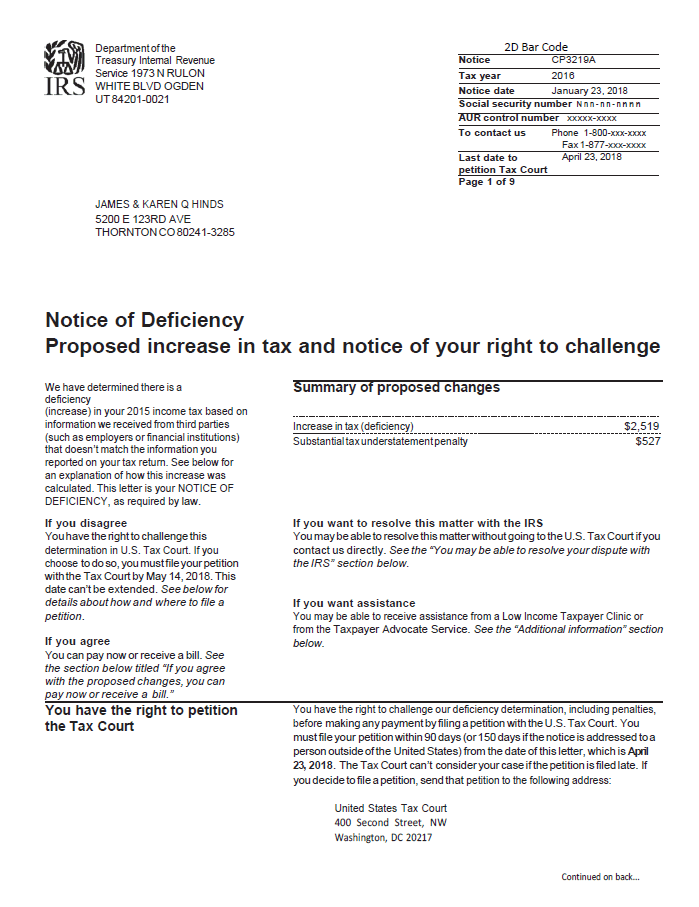

Notice Of Deficiency Overview Irs Forms Options

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

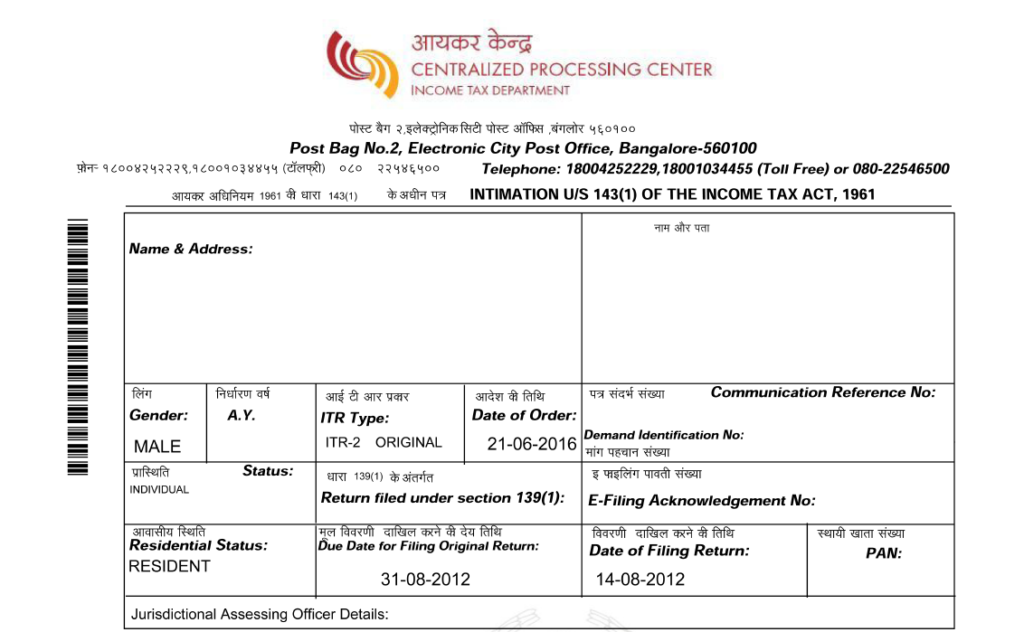

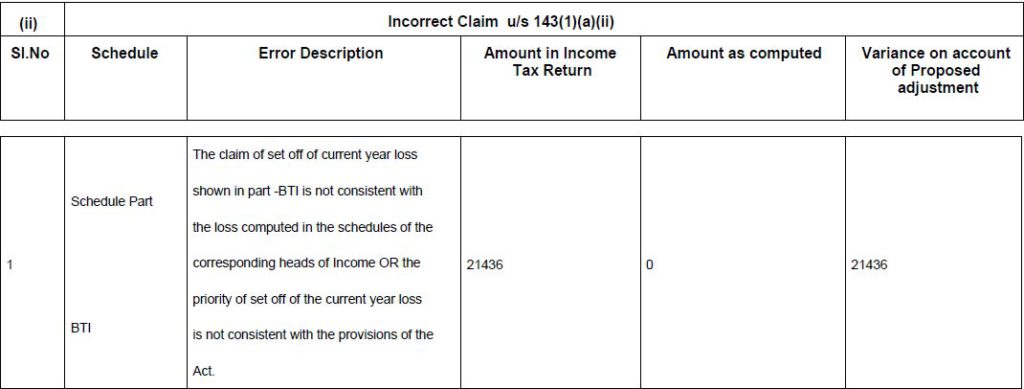

It Notice For Proposed Adjustment U S 143 1 A Learn By Quickolearn By Quicko